November 12, 2015

Co-operative Education Tax Credit

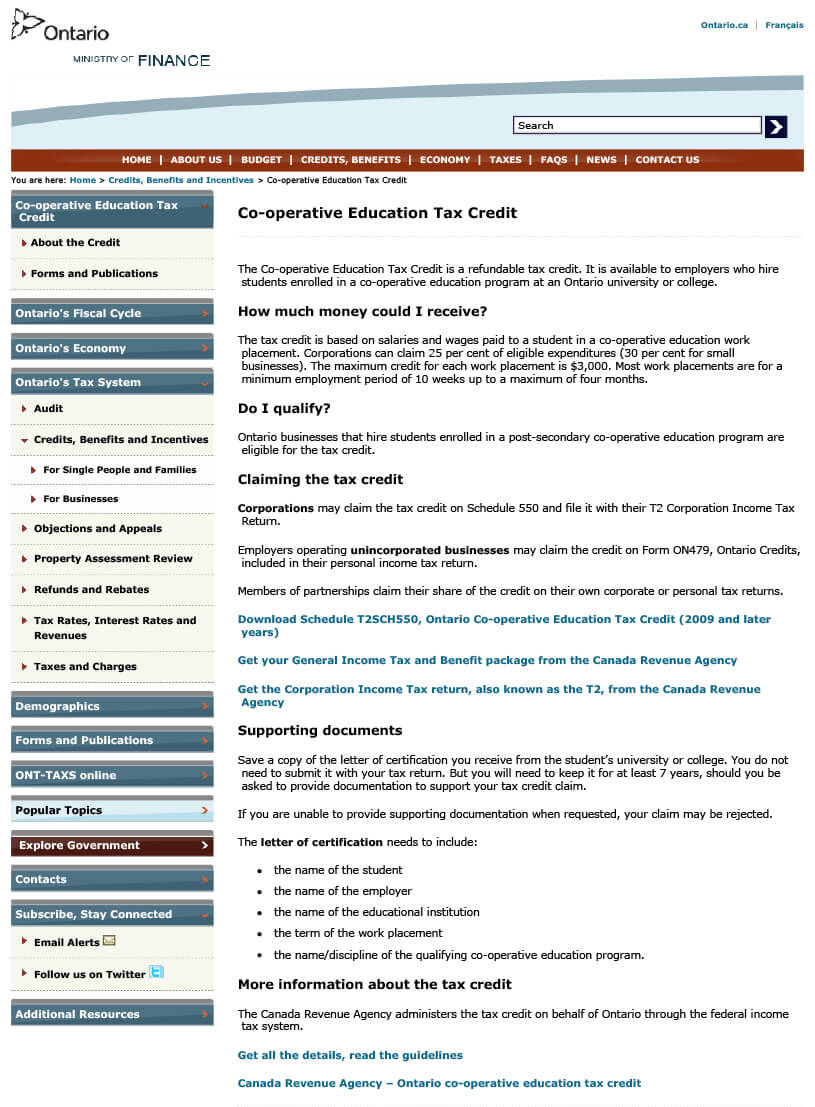

The Co-operative Education Tax Credit is a refundable tax credit. It is available to employers who hire students enrolled in a co-operative education program at an Ontario university or college.

For more information or to register your event, visit fin.gov.on.ca/en/credit/cetc/

How much money could I receive?

The tax credit is based on salaries and wages paid to a student in a co-operative education work placement. Corporations can claim 25 per cent of eligible expenditures (30 per cent for small businesses). The maximum credit for each work placement is $3,000. Most work placements are for a minimum employment period of 10 weeks up to a maximum of four months.Do I qualify?

Ontario businesses that hire students enrolled in a post-secondary co-operative education program are eligible for the tax credit.For more information or to register your event, visit fin.gov.on.ca/en/credit/cetc/